Ruike acquires Guoshen to enter the ultra-fast laser market performance, pays close attention to product quality

On the evening of June 5, 2019, Ruike Laser announced that the company had acquired a total of 51% of the shares of nine shareholders of Guoshen Optoelectronics for a price of 114.75 million yuan. So far, Ruike Laser has become the controlling shareholder of Guoshen Optoelectronics Technology (Shanghai) Co., Ltd., and officially entered the ultra-fast laser market.

What kind of company is Guoshen Optoelectronics

Guoshen Optoelectronics was established in 2011 and is mainly engaged in technology development, transfer, and services in the fields of optoelectronic technology, opto-mechatronics, and network technology. Guoshen Optoelectronics Technology (Jiaxing) Co., Ltd., a wholly-owned subsidiary of Guoshen Optoelectronics, was established on May 27, 2016. It is mainly engaged in the research and development, production and development of laser devices, optical communication equipment, optical communication measuring instruments and accessories. Sales.

It is understood that Guoshen Optoelectronics is the first industrial ultra-fast laser manufacturer in China, occupying more than 60% of the market share in the LED chip segment; it also entered glass cutting and flexible material cutting, but its share was small. Guoshen Optoelectronics’ research and development team in order to expand market segments and increase sales share, incurring a large amount of research and development costs every year, as of the end of 2018, has obtained 2 invention patents, 11 utility model patents, 6 proprietary Technology and 2 software copyrights. Under the leadership of Dr. Zhou Shi’an, the leader of research and development, Guoshen Optoelectronics has successfully developed an all-fiber integrated high-power femtosecond laser with international advanced technology.

According to the audit of the accounting firm, Guoshen Optoelectronics’ results in the past three years were 21,485,100 yuan, 28,114,300 yuan and 19,547,000 yuan, and its revenue in the first quarter of this year was 4.5007 million yuan, which shows that after the overall outbreak of the laser industry in 2017, it showed a downward trend. The company’s net profit was RMB 5.5413 million, RMB 7.122 million, RMB 6.387 million, and RMB 997,700, respectively. They also showed a downward trend after 2017, but the gross profit margin of Guoshen Optoelectronics has remained above 60% for many years. In addition, as of March 31, 2019, Guoshen Optoelectronics had a net cash flow of -18.651 million yuan.

Data source: Guoshen Optoelectronics asset evaluation report and Ruike Laser related announcements

What is the benefit of the acquisition of Guoshen

Although Guoshen’s weight is very small compared to Ruike, it will not have much impact on Ruike’s laser performance in the short term, but Guoshen’s technical strength and research direction are a very powerful supplement to Ruike.

In 2018, Ruike’s laser revenue was 1.462 billion yuan, of which pulse fiber laser revenue was 223 million yuan, an increase of 27.04% year-on-year, and continuous fiber laser revenue was 1.115 billion yuan, an increase of 55.17% year-on-year. The two together account for the fiber laser market in China Accounted for 17.3%. In addition, Ruike Laser’s direct semiconductor laser has also achieved good results, and its annual revenue has increased by 317.44% year-on-year. However, due to the focus of business, while the rapid development of fiber lasers, ultra-fast lasers have become a short board of Ruike. Making up for this technical shortcoming is of great significance in the increasingly mature situation of the ultra-fast laser market.

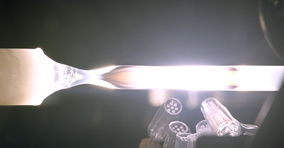

Through the acquisition of Guoshen Optoelectronics, Ruike Laser will realize the research and development, production and sales of ultrafast laser products, further expand Ruike Laser’s product line and customer group in the laser industry, and complete the development of fiber lasers, semiconductor lasers and ultrafast lasers. The layout of the industrial chain will enhance the company’s overall competitive advantage, profitability and core competitiveness, and add new business with great development prospects to Ruike Laser. At the Shanghai Optical Expo in March this year, Ruike Laser launched three ultra-fast lasers with broad market applications jointly designed with Guoshen Optoelectronics, namely 100W infrared picosecond laser, 20W ultraviolet picosecond laser and 20W. Infrared femtosecond laser.

Gambling agreements focus on product quality

After the acquisition, Dr. Zhou Shi’an, General Manager of Guoshen Optoelectronics, promised the company’s development plans for 2019, 2020 and 2021: “Guoshen Optoelectronics will develop and implement new femtosecond and picosecond sales products based on market demand. For three types, the specific product requirements will be determined according to market demand and Guoshen Optoelectronics technology progress and Ruike Laser and Guoshen Optoelectronics. After the new product development is completed, Guoshen Optoelectronics will sell or sell at the market price by itself or through Ruike Laser. The product shall be approved by the customer in writing. “

It is understood that the overall goals of the three product developments are: high-power picosecond lasers, ultraviolet high-power picosecond lasers, and high-power femtosecond lasers. Each product has sold more than 10 units to prove that the products have reliability. After proving that the product performance is reliable and stable through the above methods and meeting customer needs, Ruike Laser and Guoshen Optoelectronics jointly completed subsequent mass production and sales. If Guoshen Optoelectronics fails to fulfill the above-mentioned promised goals in three years (that is, after the cumulative calculations in the above three years, the effective sales volume of the three types of products agreed by the customer’s written acceptance has not reached 10 units respectively), it should be in 2022 In the first quarter of this year, compensation was made for Ruike Laser at one time. The compensation scheme is as follows:

Dr. Shi’an Zhou’s performance commitment is quite different from the current betting agreements commonly used in the capital market. The most common gambling agreement in capital mergers and acquisitions usually revolves over the non-net profit of the acquiree, which may cause the acquiree to reduce R & D investment under profit pressure, which will affect the company’s long-term competitiveness. The editor of OFweek Lasernet believes that the long-term vision of Ruike Laser can be seen through the performance commitment made by Dr. Zhou Shi’an: Regardless of short-term profit and loss, only focus on product quality, and urge subsidiaries to make full efforts to make products for market expansion Lay the foundation and make preparations.

Ultrafast laser market status

The industrial application of ultra-fast lasers is very wide. With the development of new applications such as consumer electronics, new displays, biomedicine, 3D printing, and high-end equipment, the requirements for laser processing precision are getting higher and higher. Ultra-fast lasers have become precision machining. Important direction. At present, in the core ultrafast laser market, foreign companies occupy nearly 90% of the global market share. Representative companies include IPG, coherence, spectral physics, TRUMPF, NKT, EKSPLA, Lihgt Conwersion, lumentum, EdgeWave, AMPlitude, etc.

Although foreign companies have a large first-mover advantage, the Chinese government, scientific research institutions, and enterprises attach great importance to ultrafast lasers. Policy tilt and increased investment by companies to overcome difficult technologies are catching up with international advanced levels. Universities such as Tsinghua University, Institute of Physics / Institute of Optomechanics, Chinese Academy of Sciences, and Huazhong University of Science and Technology are vigorously promoting the research of ultrafast lasers; the four major laser industry belts have also bred a number of high-quality enterprises dedicated to ultrafast lasers.

First look at the Central China Laser Industry Belt represented by Wuhan Optics Valley. The ultra-fast laser companies in the Huazhong Laser Industry Zone include: Huari Laser, which integrates the technology system of solid-state lasers and fiber lasers; masters the generation and diagnosis of fiber seed laser sources; the design of high-power and high-energy all-fiber polarization-maintaining fiber amplifiers; Anyang Laser, which is a key technology for fiber manufacturing and wavelength conversion technology; is committed to building China’s first femtosecond laser processing center, and launching new technology of Hongtuo, an industrial high-power femtosecond laser.

As another major agglomeration center of China’s laser industry, the PRD laser industry belt also has a number of ultra-fast laser-related companies, including: Asia’s largest market size, a large number of picosecond, femtosecond lasers and terminal equipment. Han’s laser with independent intellectual property rights; Inno laser equipped with a full range of lasers ranging from nanoseconds, picoseconds to femtoseconds, from infrared, green, ultraviolet to deep ultraviolet; focus on the development of ultra-fast laser light sources and high-end industrial lasers The solution is Hua Kuai Photon; Han Ying Laser, which focuses on technological innovation and independent research and development, and specializes in picosecond and femtosecond fiber lasers.

The Yangtze River Delta region is one of the main gathering areas for the laser industry in China, and the laser industry chain has been perfected. The ultra-fast laser companies in the Yangtze River Delta laser industry belt include: advanced cavity design and laser control technology, self-developed fiber seed source technology and unique amplifier technology, and a total of more than 800 Bellin lasers shipped in picosecond lasers ; Dedicated to providing multi-functional, high reliability, and cost-effective mid-infrared laser products for existing and emerging applications. The core products include mode-locked laser oscillators, erbium-doped fiber amplifiers, broad-spectrum light sources, and various types of continuous lasers. Nuopai laser; pulse width covers from continuous to femtosecond, wavelength covers from ultraviolet to infrared, and can provide multi-wavelength synchronous output. With the laser amplification module, the average power can be customized.

The strong demand for laser products in the Bohai Rim region has driven the development of the laser industry in this region. The ultra-fast laser companies in the Bohai Rim laser industry belt are: the three main product lines of industry, scientific research and medical treatment. In 2018, Zhuo Rai Laser, a full-screen cutting infrared picosecond laser with more than 200 sales; high-end semiconductors controlled by the Chinese Academy of Sciences A professional manufacturer of pump lasers and solid-state lasers. Guoke Laser has mass production lines of ultraviolet, green, infrared and picosecond lasers; it has 20W, 50μJ femtosecond lasers, 10W-60W picosecond infrared lasers of various grades, and multiplied by frequency The Tianjin Kaipulin of the obtained green and ultraviolet lasers; relying on the technical advantages of the Institute of Physics of the Chinese Academy of Sciences and Beijing Wuke Optoelectronics Technology Co., Ltd., it is committed to the research and development and production of high-end laser products such as ultra-fast lasers and narrow line-width lasers. Yancheng Wuke Optoelectronics and so on.

With the development of “Industry 4.0” and “Made in China 2025” in Germany, the demand for high-end manufacturing, intelligent manufacturing, and high-precision manufacturing will increase significantly, especially the rapid development of the consumer electronics field, which will bring transparent and translucent material lasers. The huge market demand for processing is a new blue ocean market. Ultrafast laser and advanced micro / nano processing technology will usher in new development opportunities. It is estimated that the total ultrafast laser market will exceed 1.5 billion US dollars by 2020.